Latest on MJJC

- Latest Michael Jackson News

- Click Here to Join Our Community

- Follow us on Twitter

- Wanna talk Michael? Come join the chat rooms

- The Michael Jackson Chart Watch

- Become an MJJC Patron

- Join the Premium Member Group and Get Lot's of Extra's

- Major Love Prayer - Worldwide Monthly Prayer Every 25th

- MJJC Exclusive Q&A - We talk to the family and those in and around Michael

- Join us in the Chat Rooms

- Find us on Facebook

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Sony proceeds with plan to sell music publishing unit: WSJ

- Thread starter Soundmind

- Start date

Universal would be fantastic for Michael's projects, not sure about the music side though.. but still, a collectors label would be my choice... anyone got a spare billion? haha

Music publishing (aka Sony/ATV) has nothing to do with MJ releases.

KOPV

Proud Member

- Joined

- Jul 25, 2011

- Messages

- 13,084

- Points

- 113

ivy;4110730 said:Can Universal buy it though? There are antitrust laws in USA (and Europe) that doesn't allow monopolies. Both Sony/ATV and Universal has around 22% Market share. EMI is around 10% and warner is about 14% and the remaining is independents. If Sony sells both their shares in ATV an EMI, Universal might not be able to buy those due to antitrust laws.

edited to add: From billboard article - Sony Corp. and Jackson’s estate also own a combined 39.8 percent -- 29.8 percentage points by the former and almost 10 percentage points by the latter -- of EMI Music Publishing, thanks to a consortium put together by then-Sony Corp. of America CFO Rob Wiesenthal.

So Sony owns almost 30% of EMI while Estate owns 10% of EMI. Given EMI has 10% market share, Sony's share of EMI is 3% of the whole market. Sony's ATV share is 11% of the market. so 14% of market. Universal already has 22% of the market, buying Sony's shares would put them at 36% - which might not be approved due to antitrust laws. Of course Universal can always arrange a consortium and buy some but all the shares.

You know Ivy that's a good question, I am in no way a legal expert and if there is one here please chime in...

I will say that considering that companies often find the loop holes in 'antitrust' laws and buy out products, companies etc. I think it's not too far fetch to say the possibility is out of the question.. With that, many antitrust laws are established to rid the competition from preventing them from earning.. Many are basically agreements without industries NOT to do certain things depending on the product they are selling.. (Sell at specific prices, don't sell into specific regions, sell at specific times etc) Basically so they don't step on each others toes and have a "turf war, on a global scale"

Considering Sony wants to sell I would believe it would give the competition the option to buy.. Sony knows that something that large is going to be purchased by a company - and most likely a company that deals with music publishing. ie a company like Universal Music Group!!

A single person purchasing it is very unlikely and IF that were the case the first thing that person would do is venture with a record company, either way it would be attached to another label if they sell so I have to ask myself. Why would they fight it even IFFF it were to cross some Antitrust laws.

HIStory

Proud Member

- Joined

- Jul 25, 2011

- Messages

- 6

- Points

- 0

Just a reminder:

December 2014

http://www.bloomberg.com/news/artic...-to-sell-music-publishing-unit-owning-beatles

January 2015

http://www.bloomberg.com/news/artic...to-sell-music-publishing-business-lynton-says

December 2014

<header class="standard-image-lede standard-lede lede"> Sony Planned to Sell Music-Publishing Unit Owning Beatles

<time class="published-at time-based" datetime="2014-12-23T19:33:44.371Z" itemprop="datePublished">December 23, 2014 — 8:33 PM CET</time> Updated on <time class="updated-at__time" datetime="2014-12-24T06:43:17.003Z">December 24, 2014 — 7:43 AM CET</time>

<figure class="inline-image inline-media">

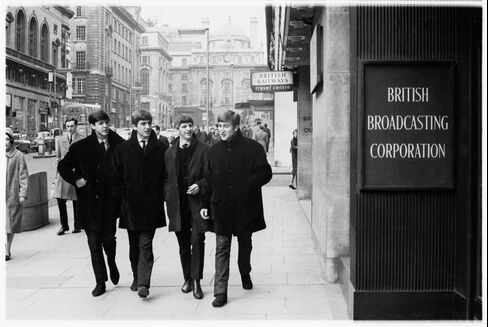

<figcaption class="inline-media__info"> The Beatles are seen outside the BBC Paris Theatre in London in this April 4, 1963 handout photo. Source: Apple Corps Ltd/Universal Music Enterprises via Bloomberg

</figcaption> </figure> </header>

<section class="article-body" itemprop="articleBody"> (Bloomberg) -- Sony Corp. was considering the sale of its music-publishing business, including a partnership with Michael Jackson’s estate that owns the Beatles catalog, as recently as last month, e-mails released by hackers show.

The “top secret” plan was being handled in the U.S. by Sony Entertainment Chief Executive Officer Michael Lynton, Sony Corp. of America President Nicole Seligman and their U.S. Chief Financial Officer Steve Kober, according to a Nov. 21 e-mail from Kober. The company had concluded the business had few growth prospects.

Top management at Tokyo-based Sony was concerned about the complex ownership and governance of the business, whose owners also include billionaire David Geffen and Abu Dhabi investors. Details of the sale plan, including possible terms or suitors, couldn’t be determined. The documents were released as part of the cyber-attack on Sony over the movie “The Interview.”

Katie Schroeder, a spokeswoman for Sony at Rubenstein Communications, declined to comment.

Shares of Sony surged 4 percent to 2,568.5 yen in Tokyo, extending this year’s gain to 41 percent.

Publishing accounts for 14 percent of Sony’s music revenue, the main part being recorded music. Sony Corp.’s Chief Financial Officer Kenichiro Yoshida raised questions about the future of music publishing in an Oct. 3 e-mail to his boss, CEO Kazuo Hirai, and Lynton, in a prelude to a meeting of the three, according to messages released by the hackers.

Sony Deliberations

“I’d like to hear your thoughts on the Music Publishing business, which has a rather complex capital and governance structure and is impacted by the market shift to streaming,” Yoshida wrote in the message.

Sony’s deliberations on the publishing business were included in a planning document sent to at least half a dozen Sony executives, according to the Nov. 21 e-mail. That included a presentation that outlined they were considering the sale.

“We are very surprised that the attached listing includes the comment about the sale of Sony/ATV,” Kober wrote. “As you know quite well, this is a top-secret project that is being handled by me working directly with Michael and Nicole.”

The publishing division includes Sony/ATV Music Publishing and EMI Music Publishing.

Music Mergers

Sony/ATV was established in 1995 as a joint venture between Sony and Jackson, who had acquired ATV 10 years earlier. Former Beatle Paul McCartney had also tried to purchase the catalog.

In 2012, Sony paid $2.2 billion for the larger EMI Music Publishing, along with investors including Jackson’s estate, Blackstone Group’s GSO Capital Partners LP, Geffen and Mubadala Development Co. owned by the Abu Dhabi government. Sony/ATV administers EMI on behalf of the investors. Messages left for Geffen, Mubadala and Blackstone weren’t returned.

Music publishers collect royalties from album sales, use on TV and other performances. The combined Sony publishing business represents stars from Bruce Springsteen to Lady Gaga and more than 2 million songs, including “New York, New York,” “Jailhouse Rock” and “I Heard It Through the Grapevine.”

The Japanese company and Jackson’s estate each own half of Sony/ATV, which owns more than 750,000 songs, according to a press release from 2012. EMI Music Publishing, in which Sony holds a 30 percent stake, has 1.3 million songs in its catalog.

Together, Sony/ATV and EMI represent the world’s biggest music publishing business, with Sony estimating a global market share of more than 30 percent.

The music publishing business generates about $500 million in annual revenue and $100 million in operating profit, according to a mid-range plan of Sony’s music business in October that was released by the hackers.

Publishing Growth

Sony’s music-publishing business will probably see sales rise 13 percent over three years to $617 million by fiscal year 2018, according to the mid-range plan circulated internally. Operating profit may rise 23 percent to $123 million during that period.

The e-mails were released as part of a devastating hack on Sony that the FBI said was committed by North Korea over the Hollywood studio’s plan to release the satirical movie “The Interview,” about an assassination plot against the nation’s leader, Kim Jong Un.

To contact the reporters on this story: Lucas Shaw in Los Angeles at lshaw31@bloomberg.net; Christopher Palmeri in Los Angeles at cpalmeri1@bloomberg.net

To contact the editors responsible for this story: Young-Sam Cho at ycho2@bloomberg.net Rob Golum, Terje Langeland

</section>

http://www.bloomberg.com/news/artic...-to-sell-music-publishing-unit-owning-beatles

January 2015

<header class="standard-image-lede standard-lede lede"> Sony Has No Plans to Sell Music Publishing Business, Lynton Says

Lucas Shaw and Anousha Sakoui

<time class="published-at time-based" datetime="2015-01-10T20:32:33.602Z" itemprop="datePublished">January 10, 2015 — 9:32 PM CET</time>

Share on FacebookShare on Twitter

<figure class="inline-image inline-media">

<figcaption class="inline-media__info"> In an Jan. 8 interview, Sony Entertainment Chief Executive Officer Michael Lynton said a sale of the music publishing business that controls rights to songs from the Beatles and Taylor Swift isn’t under consideration. Photographer: Patrick T. Fallon/Bloomberg

</figcaption> </figure> </header>

<section class="article-body" itemprop="articleBody">

Sony Corp. has no plans to sell the music publishing business that controls rights to songs from the Beatles and Taylor Swift, as was suggested by leaked e-mails, Sony Entertainment Chief Executive Officer Michael Lynton said.

Sony’s music-publishing business, the largest in the world, has a catalog of more than 2 million songs. Music publishers collect songwriting royalties from album sales, use on TV and other performances.

E-mails and documents released in the cyber-attack on Sony mentioned a “top secret” plan to sell the music publishing business because it had few growth prospects, Bloomberg News reported last month. Top management at Tokyo-based Sony was concerned about the complex ownership and governance of the business.

In an Jan. 8 interview, Lynton said a sale isn’t under consideration.

Music publishing accounts for 14 percent of Sony’s music revenue, with recorded music generating the larger part. The business includes Sony/ATV Music Publishing, a joint venture with the estate of Michael Jackson, and EMI Music Publishing, in which Sony has a 30 percent stake.

Sony/ATV CEO Martin Bandier said in a memo to staff on Jan. 9 that he’s been advised by Sony Corp. that the venture isn’t for sale, the New York Post reported.

Sony/ATV was established in 1995 in partnership with Jackson, who had acquired rights to the Beatles songs a decade earlier.

Sony’s Partners

In 2012, Sony paid $2.2 billion for the larger EMI Music Publishing, along with investors including Jackson’s estate, Blackstone Group’s GSO Capital Partners LP, entertainment mogul David Geffen and Mubadala Development Co., owned by the Abu Dhabi government. Sony/ATV administers EMI on behalf of the investors.

The combined Sony publishing business represents stars from Bruce Springsteen to Lady Gaga and songs including “New York, New York,” “Jailhouse Rock” and “I Heard It Through the Grapevine.”

Sony and Jackson’s estate each own half of Sony/ATV, which contains more than 750,000 songs, according to a 2012 press release. EMI Music Publishing has 1.3 million songs in its catalog.

</section>

http://www.bloomberg.com/news/artic...to-sell-music-publishing-business-lynton-says

Last edited:

Soundmind

Proud Member

- Joined

- Jul 27, 2011

- Messages

- 3,667

- Points

- 0

Sony Corp. and Jackson’s estate also own a combined 39.8 percent -- 29.8 percentage points by the former and almost 10 percentage points by the latter -- of EMI Music Publishing, thanks to a consortium put together by then-Sony Corp. of America CFO Rob Wiesenthal. That consortium -- which also consists of Mubadala Development, Jynwel Capital Ltd., the Blackstone Group's GSO Partners and David Geffen -- paid $2.2 billion in June 2012 for EMI's publishing catalog. EMI Music Publishing itself generates about $750 million in annual revenue.

That's mean the estate forked $ 220 million for their share. This is an indication the estate in a very good financial position else they would not have invested such amount. Moreover, it seems this kind of business is considered good to them. The estate did not have really to be part of the consortium given the debts.

That's mean the estate forked $ 220 million for their share. This is an indication the estate in a very good financial position else they would not have invested such amount. Moreover, it seems this kind of business is considered good to them. The estate did not have really to be part of the consortium given the debts.

I disagree. It probably means they got a loan to buy it and they expect to pay back the loan from EMI profits. It doesn't necessarily mean that they paid anything out of their own pockets directly.

Soundmind

Proud Member

- Joined

- Jul 27, 2011

- Messages

- 3,667

- Points

- 0

which is my point. Why would they do that unless they consider it a very decent investment. The press made it seem that MJ's share in Sony/ ATV was not worth more than $ 200 millions. Now they are talking about billions and hundred of millions in a new investment. Frankly speaking I believe investing the revenues of the cataloges in long term investments like the EMI, is much better for the kids' future than distributing it to the "beneficiaries"; the Jacksons ultimate dream.

Tygger

Proud Member

- Joined

- Jul 17, 2012

- Messages

- 2,316

- Points

- 0

marc_vivien;4110745 said:LYNTON'S BUY/SELL CONFIRMATION MEMO

In an apparent effort to calm nerves frazzled by a 10/7 WSJ report on the possible sale of Sony/ATV, Sony Entertainment CEO Michael Lynton sent an email to the pubco’s staff just as the story was breaking confirming that Sony had initiated the buy/sell process with the Michael Jackson estate and explaining how it might proceed. We’ve obtained that memo; what follows is the complete text.

Dear Sony/ATV Colleagues,

Sony Corporation of America and the Estate of Michael Jackson have begun what is known as a buy/sell process, in which each will have the opportunity to buy the other’s half, or sell its half, of Sony/ATV Music Publishing.

As you know, Sony/ATV is a joint venture between Sony and the Estate of Michael Jackson and operates based on a joint venture agreement. The joint venture agreement lays out procedures for the buy/sell process. Sony considers that now is an appropriate time to review our ownership status and thus has decided to begin this process. We will decide our next steps, based on a number of factors, as this process advances.

The music publishing business has been a stable profit contributor for its partners, and we highly regard the company, its leadership and personnel, and its performance. I strongly believe that, whoever ultimately ends up owning the company, Sony/ATV will remain a great business and a leader in music publishing for many years to come.

This process has just now begun, and as noted our next steps will be based on a number of different factors. For now, I ask that you proceed with business as usual, stay focused on your work, and continue to build on Sony/ATV’s terrific legacy and success.

Michael Lynton

http://hitsdailydouble.com/news&id=297998

Good post. We have confirmation that the Estate and Sony have ROFR and ROFO rights as the Estate has with Colony for NL.

KOPV;4110750 said:You know Ivy that's a good question, I am in no way a legal expert and if there is one here please chime in...

I am not an expert; however, a monopoly does not occur with a possible 36% share. I cannot remember off hand but, I believe a monopoly occurs within the U.S. at a share greater than 75%.

Also, I do not believe this possible sale includes the EMI portion. I believe this is solely the Sony/ATV catalog ownership shares at stake (50% Sony 50% Estate).

Adding: I believe the monopoly percentage market share in Europe is even higher than the U.S. percentage of 75%. Maybe another can confirm these percentages.

Last edited:

I am not an expert; however, a monopoly does not occur with a possible 36% share. I cannot remember off hand but, I believe a monopoly occurs within the U.S. at a share greater than 75%.

Not quite. Check the old news and you would see the Sony/ATV's purchase of EMI triggered antitrust investigations in both USA and EU. Sony/ATV had 22% market share and Sony and Estate's interest in EMI would put them at 25-26% which was enough to trigger antitrust concerns. They also had to keep EMI seperate than Sony/ATV. If you read the old stories you will see that US gave approval to EMI purchase but EU asked Sony to sell certain publishing rights before they approved the sale. So anything over 25% market share would be problematic and trigger antitrust issues. Plus antitrust laws isn't about absolute monopoly, it's about one company becoming too big and having power over the industry.

which is my point. Why would they do that unless they consider it a very decent investment. The press made it seem that MJ's share in Sony/ ATV was not worth more than $ 200 millions. Now they are talking about billions and hundred of millions in a new investment. Frankly speaking I believe investing the revenues of the cataloges in long term investments like the EMI, is much better for the kids' future than distributing it to the "beneficiaries"; the Jacksons ultimate dream.

It's a good revenue source. As I posted earlier the hacked documents showed Sony/ATV brings $100 Million operating profit - profit before deducting interest and taxes. Estate uses some of the money they get to payback the loans on their share but once that debt is paid you are looking at $25 Million or more per year (assuming no decline in the industry of course).

as from the investment perspective, probably they didn't see it as a risky investment. Hacked Sony/ATV documents showed the loans they got to buy other catalogs were being paid from the revenues of the catalog. So in the end it's an asset that pays for itself.

Last edited:

michaelsson

Proud Member

- Joined

- Jan 25, 2007

- Messages

- 4,553

- Points

- 63

so this has nothing to do with Michael Jackson's future releases? great. moving on lol

Tygger

Proud Member

- Joined

- Jul 17, 2012

- Messages

- 2,316

- Points

- 0

Soundmind, if the Estate had $220M liquid to invest, it most likely would not be in the debt it is in now.

Ivy, a monopoly does indeed happens when one owns 75% of market share in the U.S., a larger share in Europe; that is what I am referring to in my response to KOPV. As I said previously, maybe another can confirm those percentages.

A parallel discussion to monopolies is anti-trust laws. In U.S. history, companies formed trusts and used those trust to gain monopoly percentages. Anti-trust laws were not created to disallow monopolies. ("There are antitrust laws in USA (and Europe) that doesn't allow monopolies.") Anti-trust laws were created to prevent monopolies from occurring and ensure fair competition. I know disallowance and prevention may be semantics for some, but, there is a difference.

It was reported Sony would have a 30%+ share of global music publishing if Sony did not sell some of their music publishing as per the encouragement of EU. This was reported as equating to Sony owning or partially owning more than 50% of UK and Ireland’s chart hits. Sony was expected to sell one of its music publishing catalogs and three of EMI’s (and other publishing rights) which, in turn, prevented EU from conducting a lengthy anti-trust investigation. 30%+ (or "anything over 25% market share") is not a monopoly percentage level which makes it more clear that anti-trust laws were created for prevention.

By the way, Sony/ATV (a partnership) was kept separate from EMI because of the ownership structure (consortium of investors).

Ivy, a monopoly does indeed happens when one owns 75% of market share in the U.S., a larger share in Europe; that is what I am referring to in my response to KOPV. As I said previously, maybe another can confirm those percentages.

A parallel discussion to monopolies is anti-trust laws. In U.S. history, companies formed trusts and used those trust to gain monopoly percentages. Anti-trust laws were not created to disallow monopolies. ("There are antitrust laws in USA (and Europe) that doesn't allow monopolies.") Anti-trust laws were created to prevent monopolies from occurring and ensure fair competition. I know disallowance and prevention may be semantics for some, but, there is a difference.

It was reported Sony would have a 30%+ share of global music publishing if Sony did not sell some of their music publishing as per the encouragement of EU. This was reported as equating to Sony owning or partially owning more than 50% of UK and Ireland’s chart hits. Sony was expected to sell one of its music publishing catalogs and three of EMI’s (and other publishing rights) which, in turn, prevented EU from conducting a lengthy anti-trust investigation. 30%+ (or "anything over 25% market share") is not a monopoly percentage level which makes it more clear that anti-trust laws were created for prevention.

By the way, Sony/ATV (a partnership) was kept separate from EMI because of the ownership structure (consortium of investors).

Last edited:

Zakk

Proud Member

- Joined

- Jan 28, 2012

- Messages

- 7,379

- Points

- 63

so this has nothing to do with Michael Jackson's future releases? great. moving on lol

if they take full control of Sony/ATV then their would be less obsticles in the way to utilize a different record label, or would Sony still own a portion after December 2017?

@Tygger

I personally don't see the need to go into this much detail on here. Regardless of the differences, the point still stands. Sony experienced antitrust issues during EMI purchase due to the 30%+ (or 25%+) end share. Given Universal already has 22% and if they buy just Sony's share or both Sony & Estate's share they would be at 33%- 44% range. That means they would most probably experience some antitrust issues. This was also mentioned by Billboard by "Universal Music Group -- though the latter could face antitrust concerns. "

This brings me back to my original comment to KOPV "Can Universal buy it though? .... Universal might not be able to buy those due to antitrust laws."

If you also think Universal may face antitrust issue in a possible purchase of Sony/ATV then regardless of semantics we agree.

I personally don't see the need to go into this much detail on here. Regardless of the differences, the point still stands. Sony experienced antitrust issues during EMI purchase due to the 30%+ (or 25%+) end share. Given Universal already has 22% and if they buy just Sony's share or both Sony & Estate's share they would be at 33%- 44% range. That means they would most probably experience some antitrust issues. This was also mentioned by Billboard by "Universal Music Group -- though the latter could face antitrust concerns. "

This brings me back to my original comment to KOPV "Can Universal buy it though? .... Universal might not be able to buy those due to antitrust laws."

If you also think Universal may face antitrust issue in a possible purchase of Sony/ATV then regardless of semantics we agree.

Tygger

Proud Member

- Joined

- Jul 17, 2012

- Messages

- 2,316

- Points

- 0

Ivy, I personally have no issue with going into detail. The detail helps to answer questions not asked, explain what may be considered a complicated matter, and allows for accuracy.

Yes, there were anti-trust concerns with Sony being part of a consortium to purchase EMI. There was no concern Sony would have a monopoly or reach monopoly level percentages of 75%+. That is what the anti-trust concerns sought to prevent. The anti-trust laws are for prevention, not to disallow monopolies. Ownership structure is the reasoning behind Sony/ATV and EMI being separate. Sony's global music publishing percentage plays no part in that separation.

Yes, there were anti-trust concerns with Sony being part of a consortium to purchase EMI. There was no concern Sony would have a monopoly or reach monopoly level percentages of 75%+. That is what the anti-trust concerns sought to prevent. The anti-trust laws are for prevention, not to disallow monopolies. Ownership structure is the reasoning behind Sony/ATV and EMI being separate. Sony's global music publishing percentage plays no part in that separation.

Last edited:

Bubs

Proud Member

- Joined

- Jan 19, 2012

- Messages

- 7,856

- Points

- 0

Part of the FT article:

The industry’s evolution from the sale of physical goods — CDs — to downloads and now to online streaming has been tough for publishers to navigate. Sales of CDs have fallen sharply over the past decade. In the past 18 months downloads have also slipped, falling more than 10 per cent in 2014, as digital streaming and services such as Spotify have grown in popularity.

The performance royalty that songwriters and composers receive for a streamed track is much lower than the fee they would receive for a piece of music sold on CD or via download.

For example, Pharrell Williams’s “Happy”, the biggest-selling song of 2014 — and published by Sony/ATV — was played 105m times on Pandora, the streaming radio service, in the first half of 2014. But the track generated royalties of only $6,300 to be shared between songwriter and publisher.

However, music publishing continues to attract investment. BMG, the Bertelsmann-owned music company, recently paid £10m for a small catalogue with one notable hit — “Walking on Sunshine”, the catchy 1985 pop hit by Katrina & The Waves.

http://www.ft.com/intl/cms/s/0/344b4168-6d50-11e5-aca9-d87542bf8673.html#axzz3nzKcIn98

The industry’s evolution from the sale of physical goods — CDs — to downloads and now to online streaming has been tough for publishers to navigate. Sales of CDs have fallen sharply over the past decade. In the past 18 months downloads have also slipped, falling more than 10 per cent in 2014, as digital streaming and services such as Spotify have grown in popularity.

The performance royalty that songwriters and composers receive for a streamed track is much lower than the fee they would receive for a piece of music sold on CD or via download.

For example, Pharrell Williams’s “Happy”, the biggest-selling song of 2014 — and published by Sony/ATV — was played 105m times on Pandora, the streaming radio service, in the first half of 2014. But the track generated royalties of only $6,300 to be shared between songwriter and publisher.

However, music publishing continues to attract investment. BMG, the Bertelsmann-owned music company, recently paid £10m for a small catalogue with one notable hit — “Walking on Sunshine”, the catchy 1985 pop hit by Katrina & The Waves.

http://www.ft.com/intl/cms/s/0/344b4168-6d50-11e5-aca9-d87542bf8673.html#axzz3nzKcIn98

Annita

Proud Member

- Joined

- Jul 25, 2011

- Messages

- 3,182

- Points

- 113

Bubs;4110869 said:For example, Pharrell Williams’s “Happy”, the biggest-selling song of 2014 — and published by Sony/ATV — was played 105m times on Pandora, the streaming radio service, in the first half of 2014. But the track generated royalties of only $6,300 to be shared between songwriter and publisher.

[/url]

Well that`s ony one streaming chanel. It would be intresting to know how much Sony/ATV generated with the Happy Song from all sources. I am sure it`s a impressive sum.

Last edited:

Tygger

Proud Member

- Joined

- Jul 17, 2012

- Messages

- 2,316

- Points

- 0

Zakk;4110837 said:if they take full control of Sony/ATV then their would be less obsticles in the way to utilize a different record label, or would Sony still own a portion after December 2017?

Zakk, I do not believe the Estate to be in the position to purchase Sony’s share of Sony/ATV. Provided the impossible happens, it would not have an effect on the contract between Sony and the Estate to release Michael’s music which is based on Michael’s masters.

By the way, Michael’s publishing is MiJac, not Sony/ATV. MiJac and Sony/ATV are separate catalogs.

jaydom7;4110877 said:can anyone get in touch with John Branca to get a statement from him? He better not sell MJ's and the kids stake in this.

No worries. You will most likely see a statement from the Estate if they sell their 50% to Sony or another which is the most likely result of this buy-sell. I would be shocked to see a statement stating the reverse - the Estate purchasing Sony's half when they cannot afford to do so.

(Adding: Hopefully Sony learned a lesson. If they sell their portion, they will employ a consultant for the sale who is not an executor for the estate that owns 50% of the asset for sale.)

Last edited:

KOPV

Proud Member

- Joined

- Jul 25, 2011

- Messages

- 13,084

- Points

- 113

I really am very curious what this will mean after the current set projects that are contracted.. Most likely good things! with new owners (even if 50%) they would be more excited with new ideas to bring to the table.. The seller always has less interest in what they can do with a product..

can anyone get in touch with John Branca to get a statement from him? He better not sell MJ's and the kids stake in this.

I'm aware that some fans already contacted the Estate but they won't comment about ongoing business matters or lawsuits. Only time they would release a statement is after the situation is resolved one way another.

I really am very curious what this will mean after the current set projects that are contracted..

It's totally irrelevant things. As respect77 and tygger have pointed out MJ's music is at MIJAC catalog. Plus Sony/ATV and Sony Music are two different things, two separate entities .

Soundmind

Proud Member

- Joined

- Jul 27, 2011

- Messages

- 3,667

- Points

- 0

Certain media outlets seem worried about the possibility of MJ's estate owning the whole catalog. "the heirs of MJ prefer to sell their stake" lol Last I heard Randy Jackson is not a heir. I doubt anyone asked Blanket what he wants.

I don't know what they mean by this. I thought both parties have a right of first offer. But they make it seem like if the estate don't afford to buy Sony's share, then Sony can buy out the estate's ! does that make sense?

I read more on this. I believe either party has the option to name the buy out price per share, ask the other party to confirm whether they would like to buy or sell at that price. The other party must take a decision. So either the estate comes up with the money to buy sony's share or they will be forced to sell mj's share to sony. From what I read it is not a wise decision to have such clause for obvious reason. I wonder why the estate agreed to such provision given that their partner is one of the biggest corporations in the world.

Sony has set off a so-called buy-sell clause in its contract with the Jackson estate that would allow either partner to acquire the half it does not already own,

I don't know what they mean by this. I thought both parties have a right of first offer. But they make it seem like if the estate don't afford to buy Sony's share, then Sony can buy out the estate's ! does that make sense?

I read more on this. I believe either party has the option to name the buy out price per share, ask the other party to confirm whether they would like to buy or sell at that price. The other party must take a decision. So either the estate comes up with the money to buy sony's share or they will be forced to sell mj's share to sony. From what I read it is not a wise decision to have such clause for obvious reason. I wonder why the estate agreed to such provision given that their partner is one of the biggest corporations in the world.

Last edited:

barbee0715

Proud Member

^^what?!! They would be forced to sell their half?? That would be horrible news.

I don't care what Sony does with their half as long as they get a good, responsible buyer who respects the catalogue.

That's why I always thought this was a perfect investment for Michael. Nobody could be more appreciative of musical history than him.

I don't care what Sony does with their half as long as they get a good, responsible buyer who respects the catalogue.

That's why I always thought this was a perfect investment for Michael. Nobody could be more appreciative of musical history than him.

Bubs

Proud Member

- Joined

- Jan 19, 2012

- Messages

- 7,856

- Points

- 0

Apparently this is what buy-sell clause mean. Either the estate buys or sells. Still, it might not be that simple.

I'm not sure what is going on because all along it has been reported that Sony wants to sell their share?

Leaked emails and other reports indicate that it is Sony that wants to sell, so I don't where the talk about the estate selling anything comes from?

They have this clause that gives both parties buy or sell option, which according to reports they have entered.

I though it means that they talk if there is possibility that the estate will purchase Sony's half.

If it is not possible the estate to buy Sony's half, Sony will start selling proceedings to outsiders.

If the estate cannot buy Sony's share, they can just sit back and wait until Sony has sold their share to someone and then they have new partner, but as far as I can understand, the estate is not selling, Sony is.

Ps, I think if the estate cannot buy other 50%, they should buy at least 1%, so then they have majority51% ownership of ATV catalogue.

Where did you hear that heirs prefer to sell?

Last edited:

InvincibleMJ

Proud Member

- Joined

- Nov 12, 2007

- Messages

- 2,760

- Points

- 48

I don't know much about buisness but it doesn't make any sense to me that one part of the company can force the other one to sell when they both own 50% of it.

https://en.wikipedia.org/wiki/Buy–sell_agreement

I believe their agreement was about the potential buyers (right of first offer) and possibly the price.

"Sony has set off a so-called buy-sell clause in its contract with the Jackson estate that would allow either partner to acquire the half it does not already own,"

IMO it's not about forcing the other partner to sell their share, it's about allowing the other partner to buy yours.

ETA:

Forbes: In Business? Get A Buy-Sell Agreement!

http://www.forbes.com/sites/robertwood/2011/02/07/in-business-get-a-buy-sell-agreement/

https://en.wikipedia.org/wiki/Buy–sell_agreement

A buy–sell agreement consists of several legally binding clauses in a business partnership or operating agreement or a separate, freestanding agreement, and controls the following business decisions:

- Who can buy a departing partner's or shareholder's share of the business (this may include outsiders or be limited to other partners/shareholders);

- What events will trigger a buyout, (the most common events that trigger a buyout are: death, disability, retirement, or an owner leaving the company) and;

Buy–sell agreement can be in the form of a cross-purchase plan or a repurchase (entity or stock-redemption) plan. For greater neutrality and effectiveness of the buy–sell arrangement, the service of a corporate trustee is recommended.

- What price will be paid for a partner's or shareholder's interest in the partnership and so on.

I believe their agreement was about the potential buyers (right of first offer) and possibly the price.

"Sony has set off a so-called buy-sell clause in its contract with the Jackson estate that would allow either partner to acquire the half it does not already own,"

IMO it's not about forcing the other partner to sell their share, it's about allowing the other partner to buy yours.

ETA:

Forbes: In Business? Get A Buy-Sell Agreement!

http://www.forbes.com/sites/robertwood/2011/02/07/in-business-get-a-buy-sell-agreement/

Example: You and your partner Joe run a hotdog stand as 50/50 partners. You might have a written agreement or a mere handshake. Joe dies. Do you still have a business? Is Joe’s wife or child your new partner? Do you have the right or the obligation to buy them out? If so, for how much and on what terms? Can you strike out on your own with your own hotdog stand, or are you stuck with the baggage of the old one? What if you die instead of Joe?

As this example shows, the most basic business can benefit from a buy-sell, even if it’s the only written document the business has. Disputes and confusion can result without one even in a small business, and the stakes go up with larger and more complex businesses. You can have a buy-sell agreement with two owners or with many. Suppose you have 10 owners in a family company and someone tries to transfer their shares to a competitor? Such events are easy to prevent with a buy-sell but very expensive otherwise.

Last edited:

Soundmind

Proud Member

- Joined

- Jul 27, 2011

- Messages

- 3,667

- Points

- 0

It depends on the provisions. Some buy-sell agreements provide for one party to force the other to either buy or sell. It is the wording of the articles, mainly the Rollingstone and another one, that makes it like one of the parties must eventually buy out the other party's share.

The Rollingstone said it is likely the heirs of MJ prefer to sell.

The right of first offer is it really news? The articles are talking about something very recent, something significant which Sony managed to get only a month a go. I don't know but logically speaking the right of first offer should have been in place for decades not years between MJ and Sony.

The Rollingstone said it is likely the heirs of MJ prefer to sell.

A shotgun clause is a term of art, rather than a legal term. It is a specific type of exit provision that may be included in a shareholders' agreement, and may often be referred to as a buy-sell agreement. The shotgun clause allows a shareholder to offer a specific price per share for the other shareholder(s)’ shares; the other shareholder(s) must then either accept the offer or buy the offering shareholder’s shares at that price per share.

https://en.wikipedia.org/wiki/Shotgun_clause

The right of first offer is it really news? The articles are talking about something very recent, something significant which Sony managed to get only a month a go. I don't know but logically speaking the right of first offer should have been in place for decades not years between MJ and Sony.

Last edited:

HIStory

Proud Member

- Joined

- Jul 25, 2011

- Messages

- 6

- Points

- 0

It depends on the provisions. Some buy-sell agreements provide for one party to force the other to either buy or sell.

You said it yourself: "it depends on the provisions". No one knows what are the provisions in the agreement between Sony and the Estate. Not Rolling Stone, not Billboard, no one. Who says it's a shotgun clause? Just because such a thing exists it doesn't mean the agreement between Sony and the Estate is like that.

The right of first offer is it really news? The articles are talking about something very recent, something significant which Sony managed to get only a month a go. I don't know but logically speaking the right of first offer should have been in place for decades not years between MJ and Sony.

The news are about Sony triggering the sell-buy process a month ago, not about Sony getting any kind of clause into the agreement a month ago. Whatever clauses are in the agreement they are probably there for a long time.

Last edited:

elusive moonwalker

Guests

Media s*** stiring imho

Bubs

Proud Member

- Joined

- Jan 19, 2012

- Messages

- 7,856

- Points

- 0

From original WSJ article:

"Lenders were notified when Sony triggered the exit clause last month"

I'm not business expert so I googled exit clause and this came up(seemingly exit clause means shotgun clause).

https://en.wikipedia.org/wiki/Shotgun_clause

I think if the estate cannot come up with the money, they better have a partner who can fork over the amount Sony is asking per share.

"Lenders were notified when Sony triggered the exit clause last month"

I'm not business expert so I googled exit clause and this came up(seemingly exit clause means shotgun clause).

https://en.wikipedia.org/wiki/Shotgun_clause

I think if the estate cannot come up with the money, they better have a partner who can fork over the amount Sony is asking per share.

Last edited: